The 2008-2007 Financial Crisis, or, the Subprime Mortgage Crisis, or, the Great Recession, was the worst economic and housing crash since the Great Depression. Almost 9 million people lost their jobs, unemployment hit 10%, housing prices dropped by 30% on average, and the U.S. stock market fell by approximately 50%. The entire world felt the repercussions of the housing bubble; trillions of dollars were lost worldwide. Many can be blamed for this: shady bankers lying to investors, mortgage lenders tricking homeowners into buying stuff they didn’t understand, improper assessments by the government, credit agencies underscoring the risk of MBS, housing market speculation, and deregulation, which allowed all of this to happen in the first place. Before I explain the cause, I must first explain the very confusing American financial system.

Traversing the U.S Financial System in 2007

When a person buys a home, they buy a mortgage. A mortgage is a loan where the lender can repossess the person’s home if they default. A default is when someone fails to pay back a mortgage. Realizing the profit they could gain, Investment banks created ‘Mortgage-Backed Security’ (MBS), a bundle of mortgages that can be invested in. These investors pay for the mortgage loans and then earn back interest. Most MBSs are issued by government-run or sponsored associations and corporations like the Government National Mortgage Association, Ginnie Mae; and the Federal National Mortgage Association, Fannie Mae. In the early 2000s, investments in MBSs were on the rise, from 2000 to 2005, the volume of MBSs nearly doubled to $7.2 billion. (Statista, 2023)

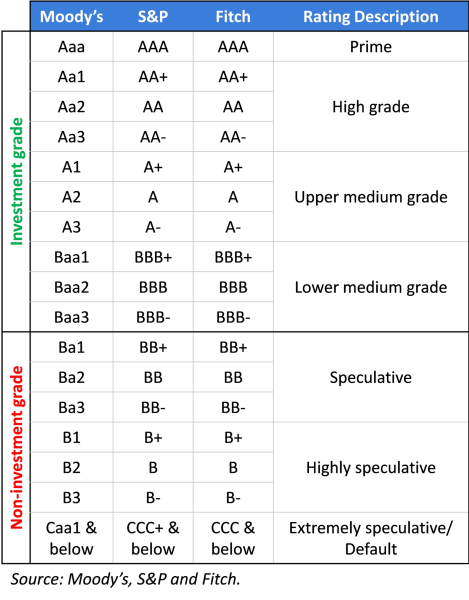

The MBSs that were being issued in 2005 were claimed to have a credit rating of AAA which refers to the safety of the bond. Credit ratings are divided up in letter grade tranches, the highest rating is AAA while the lowest rating is a D. Mortgage Agencies did not have to disclose information about the MBSs people were investing in, and people were manipulated into believing different safety ratings than those stated. The MBSs were said to be incredibly safe with an almost impossible chance of failing.

Because of the wealth this was creating, it incentivized mortgage loaners to give out mortgages to all people, disregarding the possibility of those people defaulting. Adjustable Mortgage Rates (ARM) is a form of mortgage where the interest rate may change periodically based on the value of the current housing market. Lenders purposefully persuaded customers into buying these, providing limited amounts of detail. More people who were unqualified to get these mortgages were able to get them; this made the MBSs less financially safe. This caused more people to default on their mortgages, which drove the credit rating of these MBSs to go down.

To deal with the lower credit ratings and the lack of mortgages, investment banks came up with a new plan. What they would do is take these lower credit-rated MBSs and repackage them together, forming larger bonds; these are called Collateralized Debt Obligations (CDOs). This earned the name ‘subprime mortgages’ for the low ratings of the mortgages within the bonds.

There is another form of CDO called Synthetic-Collateralized Debt Obligation, which are much more complicated. Synthetic CDOs, whose reference portfolio (a portfolio is an economic plan given to investors that shows the risk and return characteristics) is made of credit default swaps. A credit default swap is a derivative that gives the ability for investors to exchange or minimize their credit risk with another investor. This allowed large ‘wagers’ to be made on the value of mortgage-related securities, which contributed to lower lending standards and fraud. Synthetic CDOs are used for higher-risk CDOs, which get their derivatives from less-risky CDOs. So, if the risky CDO fails, it could hurt the low-risk CDO. The bottom tranches (tranches are the different levels of credit ratings; higher tranches are higher letter grades, meaning safer) are more risky, so once synthetic CDOs of those fail, it hurts the higher tranches. Think of this like a bet on a bet, these mortgages are being betted on to succeed, then those bets are being betted on themselves. And this cycle continues indiscriminately.

The banks continued to proclaim the same stable credit ratings, while the ‘value’ of the CDO’s decreased. Investors did not understand the true value of the CDOs and how they were buying exponentially worthless mortgages. This the formation of the housing bubble. Banks started to raise interest rates of mortgage loans, which made it harder for people to pay back their mortgages. If the bottom tranches were to fail by 8%, it would cause all of the CDOs to crash, but people didn’t realize this at the time. The market for insuring mortgage bonds was 20 times the worth of mortgages at this time, right before the recession. The rate of mortgage-Backed Securities increased exponentially from 2001 to 2007. The value of American subprime mortgages was estimated at $1.3 trillion as of March 2007. (Will Subprime Mess Ripple Through Economy?, 2007)

The Crash.

In 2008, the rate of mortgage-backed securities ended abruptly. Investors backed out forcing the mortgage interest rates to skyrocket. Defaults rose exponentially. Approximately 16% of subprime adjustable-rate mortgages by October, were either 90-days delinquent or foreclosure had already started. This is triple the rate from 2 years before. More risky bonds started to fail, from -B’s to BBB+’s. Then all the way up to AAA bonds. No one expected for the triple A bonds to fail, leaving most synthetic CDOs tied to them. Some banks realized before others about what was about to happen, and so they shorted (shorting something is to bet against it. When you short something, you’ll gain money from the decline of that something) other banks’ CDOs to make up for the future loss of their own CDOs. (O’Callahan, 2022) Soon everyone realized what was happening and all banks tried to short everyone else’s CDOs.

This resulted in the housing market, Wall Street, and banking to crash, which destroyed the nation’s economy. Hundreds of banks failed, almost 9 million jobs were lost, housing prices dropped by an average of 30%, stock market dropped by 50%. U.S. bank losses were forecast to hit $1 trillion, Americans lost more than a quarter of their net worth, and total home equity in the United States, which was valued at $13 trillion at its peak in 2006, had dropped to $8.8 trillion by mid-2008 and was still falling in late 2008. Unemployment hit 10%, between 2006-2012, the national debt doubled to $16 trillion, and public pensions saw their holdings fall in value by $889 billion between 2007 and 2008. By August 2008, 9.2% of all U.S. mortgages outstanding were either delinquent or in foreclosure. By September 2009, this had risen to 14.4%. Between August 2007 and October 2008, 936,439 US residences foreclosed.

Government Response

To combat this crisis, the Bush administration signed the controversial Emergency Economic Stabilization Act of 2008. Many criticized this as it bailed out many banks responsible for the crisis. A part of this was the Troubled Asset Relief Program (TARP) which authorized expenditures of $700 billion to help stabilize the U.S. financial system, restart economic growth, and prevent avoidable foreclosures during the 2008 financial crisis. (U.S Government Accountability Office, 2023) The annual budget deficit for 2009 surpassed $1 trillion, the debt ceiling was also raised to $10.6 trillion.

Once Obama was sworn in as president, he enacted the American Recovery and Reinvestment Act of 2009 (ARRA). This act was an $800 billion stimulus program to fund industries and those who had been hurt by the crisis, part of this was also a series of tax cuts. His administration continued the bailouts, real GDP rose from $14.4 trillion in Q1 of 2009 to $16.8 trillion in Q4 of 2016, an increase of 16.6%. (Federal Reserve Bank of St. Louis, n.d.) Luckily, homeowners were able to recover and were able to look to see who and what was to blame for this disaster.

FDR’s ‘Socialist’ New Deal and the Glass–Steagall Legislation

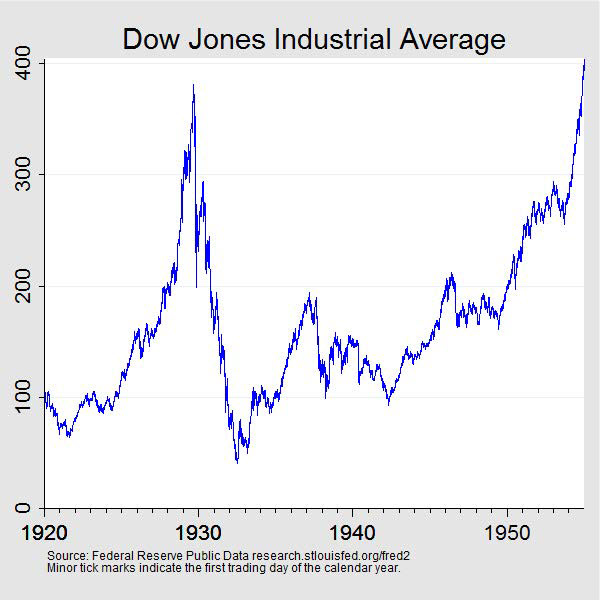

Franklin Delano Roosevelt was elected President of the United States in 1933, inheriting a nation in turmoil, much like future President Obama would face. He inherited the Great Depression, a massive market crash on Wall Street in 1929, which left people starving for a decade. Herbert Hoover, the previous President, was voted out after one term for his horrible response to the crash. FDR had a lot of trust placed in him to solve this crisis, his plan was the New Deal.

The New Deal included numerous programs, including financial reform and regulation, to quickly fix the damage from the ongoing crisis, and to eliminate the threat of another one in the future. This plan was a massive success but not without critics, many in the press slandered FDR, stating he was a socialist. Socialist or not, his abilities not only got us through the depression but also the second world war.

One element of the new deal was the creation of the Glass-Steagall Legislation. This piece of legislation acted as a firewall between commercial and investment banks. It mandated that banks pick the role of either, disabling commercial banks from acting like investment ones. The combination of these two sectors before the Great Depression are believed to have been the cause, so it was very important for this legislation to stay. But, in 1999, under the Clinton administration, the legislation was repealed, believing it would limit the diversification of banks. This proved costly, as it was one of the many reasons that led to the crash. Without the law, banks were able to proceed in both commercial and investment markets, this caused numerous financial institutions to become bloated. One of them, Bear Stearns, which was estimated to be worth over $200 million, collapsed during the Recession.

We are able to see the effects of the Glass-Steagall Repeal, but it wasn’t the only mistake made.

The Faults of Deregulation

The financial industry was heavily regulated after the Great Depression, and for the next 4 decades that came after, there was not a single financial crisis. In the 70’s, the U.S. started to experience stagflation, economists blamed the Keynesian model developed from FDR’s practices. The Chicago School of Economics popularized the belief that regulations choked banks from operating properly. They also popularized the fear of Globalism, deriving the narrative that we are unable to keep up with competition from foreign nations due to banks’ decreased power.

Many deregulations during the administrations of numerous Presidents let lenders and banks undermine the American-people using ‘evil’ tactics.

Ronald ‘Contra’ Reagan

Ronald Reagan, the godfather of modern-Republicanism was elected president in 1981, he quickly started to escalate deregulation across all industries; including the financial industry. It’s impossible not to talk about ‘trickle-down economics’ when referring to Reagan’s horrible financial decisions. Trickle-down economics is the concept that policies that benefitted corporations and the upper class would end up trickling down and help the ‘poor.’ Though it brings someone to ask, if they wanted to help the poor, why not just help the poor? No studies have shown that trickle-down economics has benefited the middle or lower class in any way.

Congress passed in 1982, the Garn-St. Germain Depository Institutions Act, “a federal law that allows lenders to enter into or enforce contracts, including mortgage agreements, which have due-on-sale clauses even if a state’s constitution or laws, including their judicial decisions, prohibit such clauses.” (Miller, Miller, & Canby, 2023) It allowed banks to make adjustable-rate mortgage loans, which was what made it possible for lenders to trick homeowners, and for default rates to rise.

In his second term, President Ronald Reagan appointed Alan Greenspan as Chairman of the Federal Reserve. Greenspan gave regulatory responsibility to the Federal Reserve Bank of New York, composed of bankers who were against regulation. He continued his deregulation into the 2000’s, lowering the required margin requirements for stock trading and access to dedicated derivatives.

Suddenly degranulation culture was popular on both sides of the aisle, Republicans and Democrats both performed deregulation throughout the 80’s and 90’s. Economists were quick to state the GDP increase was because of this culture.

Was This Monica’s Idea?

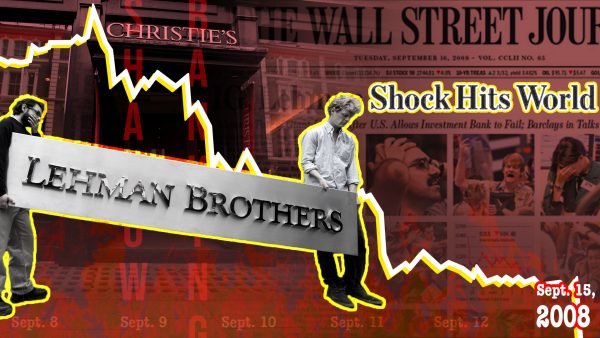

As the 90s came full speed, Democrat Bill Clinton was elected President. He held similar beliefs to Reagan, believing regulations made it harder to compete in foreign markets. He believed it was important to roll back the ‘Depression-era’ regulations. Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 was signed by Clinton, which rolled back the McFadden Act of 1927. This act permitted banks to operate only within the state in which they were located, but this was reversed because the Clinton administration wanted to balance the benefits of federal and state bank charters. The GDP percentage that the 6 largest banks made up went from 20% in 1997 to 60% in 2008. This is a disgusting increase in wealth and power, proving this deregulation consequently gave the ability for lenders to mismanage and then create a financial crisis. The banks understood their own power and knew they could make risky decisions and fall back on government spending if there was a crisis, which is exactly what happened. But, one bank, the Lehman Brothers, was not bailed out and, in turn, collapsed. This cost approximately 26 thousand of the firm’s employees worldwide to lose their jobs. (Harvard Business School, n.d.)

In 1998, Brooksley Born, the director of the Commodity Futures Trading Commission, learned of the risk that new banking practices created for the financial market. He proposed new regulation but was denied by numerous government agencies, including the SEC, the Treasury Department, and the Financial Reserve. Later in 2000, Senator Phil Gramm created a bill called the Commodity Futures Modernization Act of 2000, which banned continued regulation of the derivative industry. It was at this time banks created the derivatives; collateral debt obligation, CDO; and credit default swaps, CDS.

“A Second Regulation Has Hit A Bank, the Elite are Under Attack.”

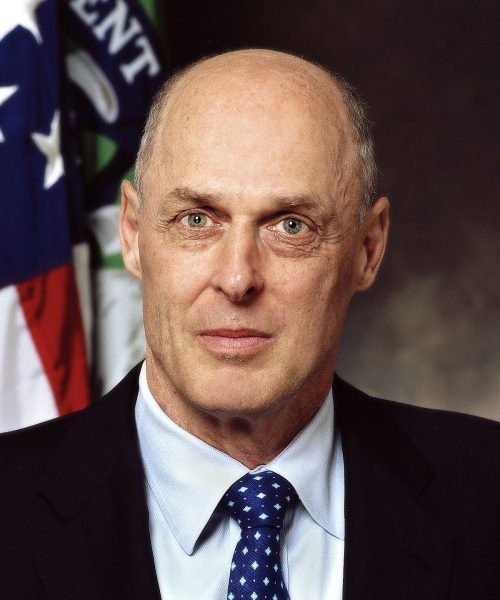

In 1975, the SEC created the ‘net capital rule’ that directly regulated the ability lenders had to meet financial obligations to creditors. This was ‘relaxed’ in 2004 during the Presidency of George Bush, when Henry Paulson, the CEO of Goldman Sachs, lobbied for the rule to be changed. Because of this, the leverage ratio (Debt-to-Assets Ratio = Total Debt / Total Assets) of banks like Goldman Sachs went from 33 to 1. This created a hinge where if 3% of debt were to fail, everything would collapse, which again is exactly what happened. Paulson later went on to be the Secretary of the Treasury in George Bush’s second term.

Banks also practiced creative accounting, which are methods to use loopholes to evade laws and regulations, they were able to take more financial risks to temporarily increase profits. Yet no more rules or regulations were put on these banks to stop this. When the crash started, the SEC didn’t investigate any banks, even after it was known those banks were participating in ‘junk bonds,’ bonds that were extremely high risk and falsy advertised to investors.

Throughout the ’90s and early 2000s, Fannie Mae and Freddie Mac used $200 million to lobby the government. They had successfully “stave off increased regulation and preserve special benefits such as exemption from state and local income taxes and the ability to borrow at low rates.” (The Politico, 2008) Fannie Mae’s CEO, James Johnson, lobbied the government to lower the writing standards for Fannie Mae from 20% down payment to only 5%. Through alternative qualifying, Fannie Mae relaxed numerous lending laws, including the analysis of borrower risk, allowing the subprime mortgage crisis to happen.

What Can We Learn From This?

During the years 2007-2009, the United States created the second-worst financial crisis the world had ever seen. It was caused by horrible deregulation practices that allowed banks and lenders to maximize profits by undermining homeowners and investors. So what can we learn from this?

Amid the quickening right-leaning path both political parties are on, regulation has gone out the window. It’s been replaced with the ignorant justification, ‘fiscal expenditure,’ and now we have seen the major consequences of so. We need to make our government and financial institutions more responsible and not deregulate and let corporations screw over the common man. Donald J. Trump will be the next President of the United States, so we can only be certain that he will lack the responsibility so many other Presidents have shared.