President-Elect Donald J. Trump has continued expressing his half-baked plans with a familiar sense of uncertainty across the media. His inability to properly state-specific details about his tariffs is very worrying, jumping back and forth between radically different percentage points.

Graphic: Annette Choi and Katie Lobosco, CNN

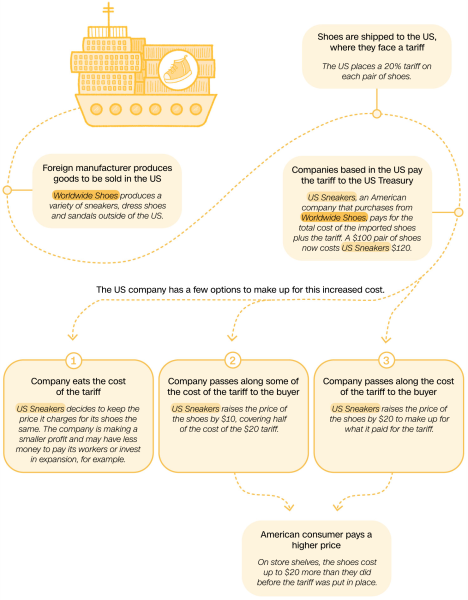

Tariffs are taxes on imports. For example: if the United States were to put a 10% tariff on China, the American companies that import Chinese goods would receive a 10% tax. Tariffs are inflationary, meaning they directly cause inflation and raise the costs of goods in a nation.

Trump has stated that his tariffs will make ‘countries pay for what they owe us,’ obviously Trump has no clue what tariffs are. This is ironic considering he also said, “To me, the most beautiful word in the dictionary is tariff. And it’s my favorite word.”

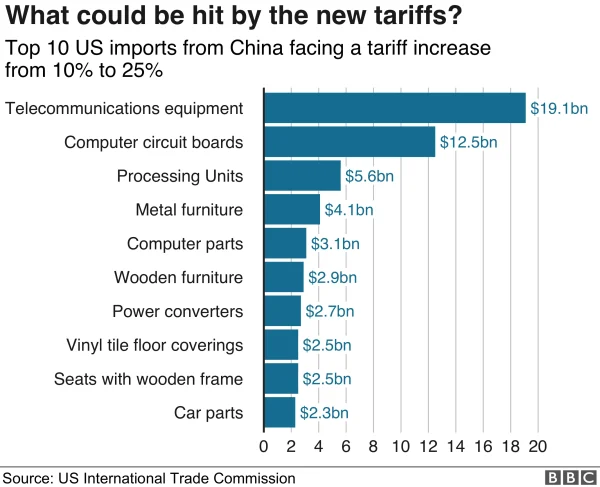

During Trump’s previous Presidency, he enforced an $80 billion tariff on China, which President Biden has mostly kept. What has resulted is a massive reduction in manufacturing jobs and a vast price hike for consumers. The Washington Post recently asked Trump if he plans to enact a 60% tariff on China that he had previously claimed, he responded by saying, ‘no, I would say maybe it’s going to be more than that.”

So what are Trump’s tariff plans and what would they mean for consumers?

The issue with dissecting many of Trump’s economic plans is his lack of repetition. Tariffs are a major example, as he has floated tariffs ranging from 10%-1000% universally. So let’s give it to actual economic experts.

Erica York at the nonprofit Tax Foundation has said that a universal 10% tariff would “raise taxes on American consumers by more than $300 billion a year.” These tariffs that Trump threatens us with, could very easily start a trade war and cause other countries to impose their own taxes on American imports. Using a model created by the Tax Foundation, York estimates that his tariffs would “reduce the size of the U.S. economy by 0.7 percent and eliminate 505,000 full-time equivalent jobs.”

Erica York at the nonprofit Tax Foundation has said that a universal 10% tariff would “raise taxes on American consumers by more than $300 billion a year.” These tariffs that Trump threatens us with, could very easily start a trade war and cause other countries to impose their own taxes on American imports. Using a model created by the Tax Foundation, York estimates that his tariffs would “reduce the size of the U.S. economy by 0.7 percent and eliminate 505,000 full-time equivalent jobs.”

Lindsay James, an investment strategist at Quilter Investors, was quoted saying, “Widespread tariffs will now likely be implemented, choking global trade in the meantime, while the deficit is likely to grow ever larger, at a time when markets are getting a little nervous about the sheer scale of spending.” And, “an emboldened Trump presidency is likely to add fuel to the fire.”

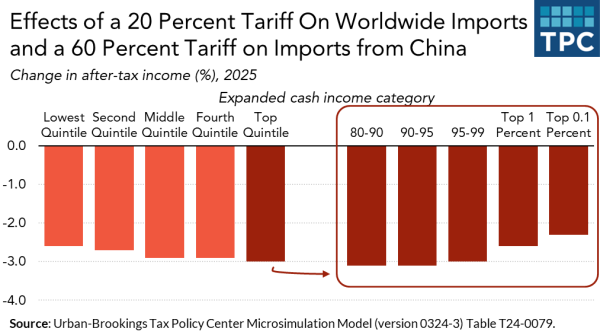

The Peterson Institute for International Economics states, “tariffs would reduce after-tax incomes by about 3.5 percent for those in the bottom half of the income distribution,” and “tariffs would cost a typical household in the middle of the income distribution at least $1,700 in increased taxes each year.” According to Statista, in 2023, 50% of Americans had an annual household income that was less than $75,000, and the median household income was $80,610. The ‘weak Biden economy’ declared constantly by Trump supporters, would crash under Trump’s tariff plans. Forecasters at Pantheon Macroeconomics claim that inflation would increase by at least .8%.

The Peterson Institute for International Economics states, “tariffs would reduce after-tax incomes by about 3.5 percent for those in the bottom half of the income distribution,” and “tariffs would cost a typical household in the middle of the income distribution at least $1,700 in increased taxes each year.” According to Statista, in 2023, 50% of Americans had an annual household income that was less than $75,000, and the median household income was $80,610. The ‘weak Biden economy’ declared constantly by Trump supporters, would crash under Trump’s tariff plans. Forecasters at Pantheon Macroeconomics claim that inflation would increase by at least .8%.

We are actually already seeing what Trump will bring, as numerous world markets have stuttered since Donald Trump won the Presidency. The announcement “slashed €17bn from Denmark’s wind power giant Ørsted after its shares slumped by 11% on the Copenhagen Stock Exchange,” reported by The Guardian.

Economists, market analysts, consumers, and people around the globe are holding their fingers together in what may come. The statistics have shown distressing truth behind Donald Trump’s economic plans.

Check back at the Trojan Tribune frequently, we will keep you updated and informed.